Fha Loan Amortization

Contents

15 Year Fha Rates The 30-year fixed loan is by far the most common loan program, but adjustable rate mortgage (arm) and 15-year fixed loans offer lower rates. If you’re ok with the higher monthly payment of the 15-year fixed loan or the possibility of your rate changing with the ARM, one of these loan programs.

FHA mortgage calculator definitions. FHA is the loan of choice for thousands of first-time and repeat buyers each month. In 2016 alone, nearly 900,000 buyers used an FHA loan to purchase a home.

Another edition of mortgage match-ups: “FHA vs. conventional loan.” Our latest bout pits fha loans against conventional loans, both of which are popular home loan options for home buyers these days.. In recent years, FHA loans surged in popularity, largely because subprime (and Alt-A) lending was all but extinguished as a result of the ongoing mortgage crisis.

Another edition of mortgage match-ups: “FHA vs. conventional loan.” Our latest bout pits fha loans against conventional loans, both of which are popular home loan options for home buyers these days.. In recent years, FHA loans surged in popularity, largely because subprime (and Alt-A) lending was all but extinguished as a result of the ongoing mortgage crisis.

· Home buyers who use FHA loans pay an upfront mortgage insurance premium (MIP) of 1.75 percent. Borrowers also pay a modest ongoing fee with each monthly payment, which depends on the risk the FHA takes with your loan.

fha versus conventional mortgage FHA vs Conventional Loan – What's My Payment? – Is an FHA loan better than a conventional loan? It’s not exactly the age old question, but FHA vs Conventional has become more relevant since 2008; when the housing market tumbled and lenders scrambled to replace their subprime menu. FHA vs Conventional isn’t as difficult as some lenders would have you believe.

What's the Difference Between PMI and FHA Mortgage Insurance. – Required on FHA mortgage loans; upfront payment and monthly premiums; May. The time it takes you to reach that threshold will depend on your amortization.

· The FHA has guidelines that applicants must meet in order to be approved for a government-backed loan. The FHA requirements are set and managed along with the U.S. Department of Housing and Urban Development.

Getting a Mortgage Loan for a Fixer-Upper: A Primer on FHA 203k Loans. The idea of buying a fixer-upper and turning it into your dream abode can seem so.

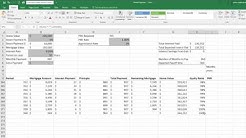

DOC U – FHA will compute a new loan-to-value ratio by dividing the new loan amount, exclusive of any upfront MIP, by the lower of the sales price or appraised value amount residing in SFIS. From this computed loan-to-value ratio, FHA will determine when the 78 percent threshold is reached based on the scheduled amortization.

Fha Amortization Schedule | Peakleadsolutions – Hunt Mortgage Group Refinances Two Multifamily Properties Located in Arizona – The loan term for both facilities is 10-years with a 30-year amortization schedule. The properties include: – Pinchot Towers Apartments. Hunt Mortgage Group provided a $2.4 million loan facility to.

Use our free mortgage calculator to quickly estimate what your new home will cost. Includes taxes, insurance, PMI and the latest mortgage rates.

Greystone Provides $22.5 Million FHA-Insured Loan for Memphis Apartment Complex – NEW YORK, Oct. 27, 2015 (globe newswire) — Greystone, a real estate lending, investment and advisory firm, today announced it has provided a $22,500,000 FHA-insured. The HUD loan carries both a 35.